BRAC Ghana Savings and Loans, launched in 2023, is BRAC International's seventh microfinance entity.

Our mission is to provide a range of financial services responsibly to people at the bottom of the pyramid. We particularly focus on women living in poverty in rural and hard-to-reach areas, to create self-employment opportunities, build financial resilience, and harness women’s entrepreneurial spirit by empowering them economically.

Our Impact

branches

borrows

savers

of clients are women

Our approach

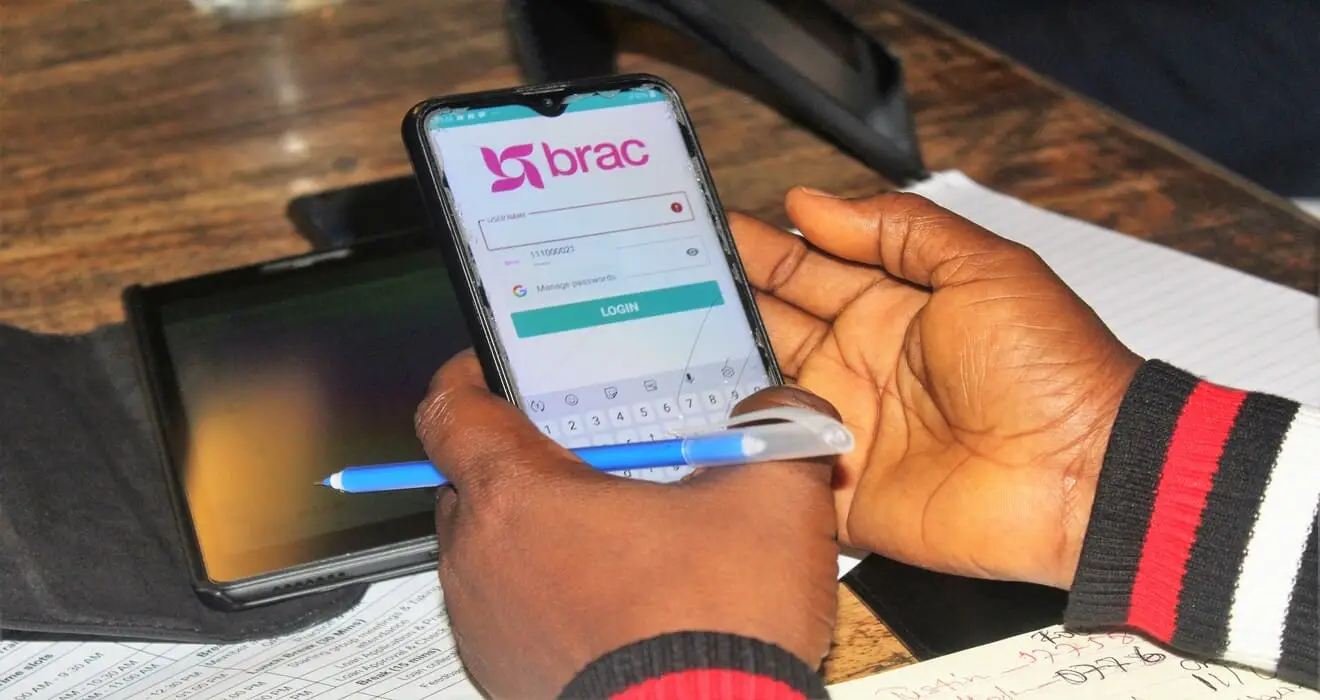

Our digital transformation prioritizes client value and women’s financial inclusion, using fintech to boost efficiency and convenience through digitized operations and alternative delivery channels.

Digital Innovation

When women have control of their finances, they are more likely to invest in family needs, such as health care, nutrition, and education for their children. We primarily focus on women, enabling them to become financially resilient and improve the quality of life of their families.

Empowering Women

Pairing microfinance with other social services can amplify the impact of our mission. We complement our microfinance services with many of our social development programs, such as youth empowerment, agriculture and food security, and livelihood programs.

Holistic Approach

We offer inclusive, accessible, and convenient loan and savings products tailored to the needs of the local community, including women, smallholder farmers, small business owners, and youth. We complement these services with financial literacy training, enabling borrowers to make informed financial decisions

Inclusive Financial Services

Our sole bottom line is creating positive impact. We deliver transparent, fair, and safe financial services, guided by global social and environmental standards, always putting clients’ well-being at the center.

Socially Driven

Program Highlights

BRAC launches microfinance institution in Ghana to empower women

BRAC has launched BRAC Ghana Savings and Loans Ltd to promote financial inclusion and empower women in Ghana's rural areas. Since November 2023, it has served nearly 1,000 clients, 99% women, with collateral-free microloans for petty trades.

Our most critical programs for women and girls depend on the generosity of people like you.

Will you help women and families change their own lives? Your gift today can enable someone to reach their potential.